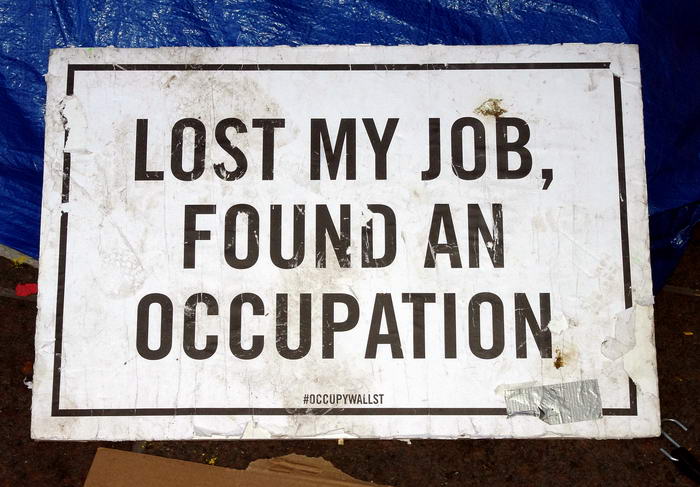

Those in the know have been investing money in the world’s stock markets for many, many years now. Whether it is the London Stock Exchange, the New York Stock Exchange or any others on the planet, putting your money into shares can help build wealth at a better rate than merely parking it in your bank account. While the current markets have taken a hit from the Covid-19 pandemic, do not be put off from investing your money here still.

This is likely to be a temporary blip and markets should recover once lockdown restrictions are lifted globally to help them out. Indeed, many say now is THE best time to invest in stocks as prices are low – buying the right shares now at a low price could really pay off in the future once the markets have recovered. Before you dive right in though, here are the ten most useful investing tips for stock market traders.

10 – Look At Past Performance

Before you buy shares in any company listed on the stock exchange, you need to conduct some careful research. Just randomly picking a name you know and buying shares in the hope it is a good investment is not wise. One great tip is to look back at how that companies shares have performed for the last 5 or even 10 years. As it is usually wise to hold your shares for an extended period to get the best return, this will give you the ideal perspective to see if is an investment worth making. After all, the share price might be up at the specific time you buy but if the last 5 years has seen it perform badly, you would be best staying away. Although past performance does not guarantee success, it is a handy indicator to look at.

09 – Check Out What Others Are Saying

This is a good tip in general but especially for new stock market investors. While you should always conduct further research after getting advice from others, it can be a good way to quickly find decent investments worth looking at. If you have a friend or acquaintance who is an experienced investor, they may be able to tell you which shares they think could be worth putting money into for example. By getting expert advice from other people, you can really boost your chances of success.

08 – Consider Investing Into Funds

Whether it is ETF’s or managed funds, investing in this way can be a great tip to take onboard. While many will opt to invest in individual companies to build their portfolio, it can pay to invest in funds instead. Some of the world’s top investors like Warren Buffet recommend this tactic as it helps to spread the risk contained in the investment itself. As funds comprise of a group of different shares from different sectors, it can really help smooth out any market dips. Many recommend an ETF linked to the S&P 500 in America as a good fund to start off with.

07 – Consider long term investments

There are many different ways you could choose to invest in stocks, from scalping to intra-day trading. While any can be profitable when done correctly, it is generally accepted that long term investment is the safest way to get decent returns. Please note that this type of investing still relies on buying the right stocks which will increase in price to begin with! Investing for the long term allows your stocks to ride out any market dips and have the time needed to recover and eventually make you money. If you are constantly selling shares each time they take a dive or are overly active in the markets, it can actually harm your profits in the long run.

06 – Keep Up With The News

As well as getting advice from other, more experienced investors, you should also plan to keep up with the daily financial news personally. This could be from online financial news sites, mobile apps or print media publications. Share prices basically rise and fall on the news as what is happening in a company or sector will impact on prices. If for example a company you have invested in bags a multi-billion dollar new contract, the share price will likely go up. One word of warning though – be careful not to overreact to every piece of gossip or snippet of news. This could see you selling shares too early or picking up shares which may not be a good investment still.

05 – Review Your Portfolio

Once you begin to invest in shares you will have a portfolio of them to look after. Your portfolio is basically all the shares you have bought in one place. This is most easily accessed through your online trading or brokerage account. Make sure to keep an eye on your portfolio over time to see how they are performing. This allows you to ditch any that have not performed well consistently or keep ones which have. As with the news, be careful not to review your portfolio too much as you need to give your investments time to play out. Once every few weeks or even per quarter is fine.

04 – Try A Demo Account First

For new stock market investors, it can all seem a bit confusing! When you first log onto your online broker account to get going, there will be lots of graphs, numbers and instruments to take in. Diving in with real money as you learn how to use them all can be costly. It is therefore a better idea to sign up for a Demo Account with your broker before trading for real. This allows you to practice with fake money and get to know how everything works with no risk.

03 – Make A Plan

One of the best tips you can get around investing in shares is to work out a plan before you begin. This is key as it will avoid you investing in a random fashion and help you to profit overall. Having the discipline to trade in the right way without a plan written out to keep you on track is tough. Your trading plan should include things like what kind of stocks you are interested in, any specific ones to track, how much you will invest per trade and how you will exit the trade. Once done, have it with you when you sit down to trade and make sure to follow it.

02 – Control Your Emotions

Investing in the stock markets is something that naturally involves human emotion. This is pretty much unavoidable as it is your own money you are risking and your own ego at stake. The problem is that emotions are bad for rational thinking and sensible investing! It is therefore crucial to control yours and stay calm to make the right calls. Whether a stock you have shoots up in price to leave you ecstatic or one falls to leave you miserable, try to control how you feel as you move forward.

01 – Set Up A Dedicated Space To Trade

Perhaps the best tip when it comes to stock market investing is to set up a dedicated space to do it from. Many try to do it from their work desk on a break or the sofa at home during the evening. The issue here is that you will not be able to focus properly or feel comfortable enough to concentrate on your research or analysis. It is much better to find a dedicated space at home which you can fill with all you need for investing – such as a laptop, a good chair, a desk and all the materials you need to trade. If you do this, you will have much more chance of success.

There is no doubt that investing in the global stock markets can be profitable. Many famous people like Warren Buffet and George Soros have shown this to be true. You will only stand a chance though if you approach it in the correct way. Hopefully, the above has given you enough information to get going!